KABUL (PAN): After passing four long years, as many as $11 million loan paid to Afghan Investment Company (AIC) by four banks— with guarantors Mahmud Karzai, Haseen Fahim and Mirwais Azizi— to the Ghori Cement Factory, however, the due loan with interests have yet to be returned to the banks.

In the backdrop of signed contract, the $11 million loan should have been returned to the banks within five years in three months installments along with its interests amounting to $7 million by December 2013.

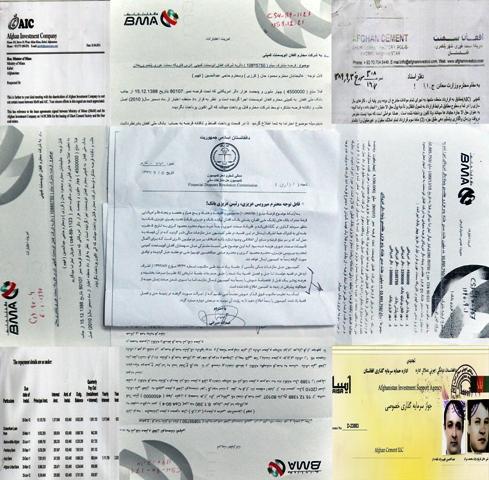

The documents received by the Pajhwok Afghan News, revealed the exact amount of the loan stood at $10,885,750 in term deposit.

As much as $4, 500,000 by Bank-i-Milli-Afghan, $2,200,000 by Afghan United Bank, $2, 185, 750 by Pashtany Bank while the rest $2, 000, 000 amount of loan was paid by the Azizi Bank.

The documents by Bank-i-Milli-Afghan show the $4, 500,000 loans under the series number 80107 on 06/03/2010 were paid to AIC and the agreed contract said its interests could be started from December 2010 but nothing could be paid in return.

Through a letter dispatched in 2010 and 2011, Bank-i-Milli Afghan requested Mahmud Karzai and Haseen Fahim to return the due installments along with its interest keeping in view the agreed contract.

Another letter by Bank-i-Milli Afghan issued after consultation and authorization of Azizi Bank, noted the $4, 500,000 loans paid to AIC under series number 80107 by Bank-i-Milli-i-Afghan, on behalf of rests of Banks, Azizi Bank asks the AIC to act according to the contract agreement and return the loans along its monthly interests.

Unfortunately, Azizi Bank failed to convince the AIC for the return of due loan with its interests after repeated letters to the concerned parties.

Bank-i-Milli-Afghan in its letters asked the private Azizi Bank to soon establish contact with AIC officials and deal with them in line with the contract otherwise Azizi Bank would be responsible for any consequences.

Banks’ officials silence:

The Bank-i-Milli-Afghan chief, Mohibullah Safi, refused to share information in line with the massive loan issue, adding they could not speak on the matter without having permission from the Afghanistan Bank.

Da Afghanistan Bank Governor, Noorullah Dilawari, said they have the responsibility of supervision from the banks, adding relevant banks should give information to media organizations but his office could not direct them in this regard.

Although the Bank-i-Milli-Afghan was functioning independently under the supervision of Da Afghanistan Bank, he said, adding but giving information to legal authorities and media was its own responsibilities.

Former chief of Pashtany Bank, Gul Maqsood Sabit, confirmed dozens of similar cases of defaulters were available with the Pashtany Bank, but he was unable to comment.

He said: “This is one of over 150 cases of loans that are available with the bank. If I speak about a particular case of loans then it tends to raise many objections tomorrow as why I am talking about a single case.”

While putting share of Pashtany Bank’s at $ 2,185,750, Sabit called private Azizi Bank responsible for the whole saga as other banks having its membership.

“We issued loan to Investment Company through Aziz Bank, so we have nothing to do with the defaulters. But we seek the loans from Azizi Bank,” he added.

He said return time for most of the loans had already been expired with some of the cases had been referred to judiciary.

A source close to the matter told Pajhwok Afghan News on December 4, due interests for the loan had yet to be returned.

Wishing not to be named, the source said AIC had not paid back its loans to the banks after series of attempts to take the loan with interest back.

However, Mahmud Karzai and Haseen Fahim have promised to return the loan of Pashtany Bank in the near future.

Commission of loan:

Azizi Bank, the leading bank in extending $11 million loan, said that $600,000 due interest of the loan had been deposited so far.

A source in the Azizi Bank said the amount of $600,000 had been deposited in three years by AIC, adding that share holders of AIC had agreed to return the $11 million loan soon.

Interest on the Loan:

According to the documents, the interest money of $11 million is calculated $6863178 at the end of 2013.

The documents revealed that AIC should have deposited 13% of the interest money, while the total interest deposit at the end of 2010 should have been $1.4 million as the first, 1.6 second and 1.8 should have been the third installment in the third consecutive year.

The financial rules of bank explain that interest should be deposited in double if not paid by due time.

Mediation by Jirga to resolve the issue:

As per established laws of the bank, it is the duty of government to ensure timely deposit of both loan with interest, however, the bank want to seek solution to the issue through Financial Dispute Solution Commission in form of a Jirga.

Abdullah Durrani, head of Financial Disputes Solution Commission, said the AIC assured the commission to pay back the loan within the stipulated time.

The meeting was held on October 27 which was attended by Mirwais Azizi, head of Azizi Bank and the shares holders of AIC Fahim Hussain and Mahmud Karzai.

Durrani told Pajhwok Afghan News Haseen Fahim and Mahmud Karzai assured the Bank to pay back the loan in one month but the time limit had already expired.

The document No. 84-77, Oct, 27, 2013 a copy of which is available with Pajhwok Afghan News says that contradiction doesn’t exist between the parties on particular amount, however different views on $2 million exist which spent for the infrastructure of Ghori Cement Factory.

According to the letter, the issue will be resolved in a participatory meeting of Afghan company Investment shareholders within two weeks.

As written in the letter, the financial dispute resolution commission asked through its letter 73-42, dated 29, October 2013, the parties involved in the case to accelerate the resolution of the issue in accordance with decisions made in the session on 27th of October and send a copy of memorandum to Dispute Resolution Commission as soon as possible. However, no progress has been conveyed to the commission.

The letter signed by the head of Dispute Resolution Commission, says, “subsequent to the mentioned letter, I request the AIC shareholders again to inform the commission formally regarding the resolutions of the issue so that the case should be returned to its authority.”

But Mirwais Azizi, chairman of Azizi Bank, says the case has been finalized and resolved and the loan will be handed over to the banks within two weeks.

“Don’t verify the case because the shareholders have reached an agreement,” he told Pajhwok Afghan News.

The contract of Baghlan cement and coal factories have been signed on September 14, 2006 for the period of 49 years between the ministry of Mines and Afghan Investment Company (AIC).

In accordance with the contract, the company should have rebuilt and reactivated the factory within three years but now the factory, and the Karkar and Dodkash mines in Baghlan are in a dilapidated condition.

Four mines including Dodkash, Ahandara, Karkar and Khord Dara and two, old and new, cement factories were handed over to AIC in 2006, which promised to reconstruct the factories and mines with bolstering its production level.

In the past, the number of share holders of the AIC stood at 34 including Mahmud Karzai and Haseen Fahim, but now the strength decreased to 23 shareholders only.

Mahmud Karzai, brother of the incumbent President Hamid Karzai, Abdul Haseen Fahim, brother of Mohammad Qasim Fahim, the first voice president, were among the main shareholders of the AIC.

But following financial crises within the Kabul Bank, Mahmud Karzai sold his share to AIC.

The money has been paid to shares of Mahmud Karzai and Qasim Fahim. But Mahmud Karzai says he has sold his share to Ghori Cement Factory in 2010 and the shareholder of the factory who has purchased his share is responsible to pay the loan.

The loan had been taken from four banks for Ghori Cement Factory and the second factory was also activated in a short time, therefore, the loan would be paid very soon.

“Before Kabul Bank went bankrupted, we expelled Sher Khan Farnood and a number of other shareholders from the factory and then took loan from four banks to pay to Kabul Bank,” Mahmud Karzai says, adding from a total of $11 million, only 2 $ million was spent on Ghori Cement Factory while the remaining $8 million was the share of Qasim Fahim’s loan and other’s which was paid to Kabul Bank.

Currently, he is not shareholder of Ghori Cement Factory. “I have sold my shares and have received the first installment,” Mahmud Karzai added.

Mahmud Karzai acknowledged he has received letters from the banks from where he got loan and he had already responded to their letters.

ra/nh/mm/aa/rm

Visits: 13

GET IN TOUCH

NEWSLETTER

SUGGEST A STORY

PAJHWOK MOBILE APP